As a company with high operating leverage generates more revenue, more incremental revenue trickles down to its operating income (EBIT) and net income. A company’s costs classified as “fixed” are incurred periodically, so there is a set schedule and dollar amount attributable to each cost. The ‘fixed’ aspect doesn’t mean they never change or cannot be managed. Rather, a fixed cost is a cost that cannot easily be reduced in the short-term, and will continue to exist even when no goods or services are being produced. With all this valuable information under your belt, you can better track manufacturing costs as they pertain to your workforce.

What is Absorption Costing?

Fixed costs also play a role in pricing decisions within organizations, so their accurate assessment is critical for success. An analytical formula can track the relationship between fixed and variable costs in management accounting. It understands the allocation of total costs between the two categories of costs. It’s crucial to divide the costs, and predicting the revenue from various unit sales changes has an impact on upcoming marketing campaigns. Another standard illustration of a fixed manufacturing overhead cost unrelated to production volume is the cost of insuring a company’s assets. A company’s total costs are equal to the sum of its fixed costs (FC) and variable costs (VC), so the amount can be calculated by subtracting total variable costs from total costs.

- Consequently, the rent and salary businesses pay each employee each month remain fixed and can be used as an example of a fixed cost.

- On the other hand, businesses that require a lot of physical assets, like airlines and automakers, will have a high level of fixed assets.

- In this way, a company may achieve economies of scale by increasing production and lowering costs.

- For example, additional machinery may need to be purchased to add production capacity.

- Fixed costs are allocated in the indirect expense section of the income statement, which leads to operating profit.

Keep Your Business Afloat With These Budgeting Methods

For example, making cement produces carbon dioxide because of the chemical reactions involved, in addition to any energy consumed. Over the year, the company sold 50,000 units and produced 60,000 units, with a unit selling price of $100 per unit. Let’s say that XYZ Company manufactures automobiles and it costs the company $250 to make one steering wheel. In order to run its business, the company incurs $550,000 in rental fees for its factory space. ProjectManager is online project management software that connects teams whether they’re in the office or on the assembly line. Our software facilitates collaboration and allows the project team to share files, comment at the task level and more.

Fixed Manufacturing Overhead: Standard Cost, Budget Variance, Volume Variance

The materials that are yet to be assembled /processed and sold are considered work-in-process or work-in-progress (WIP) inventory. Another commonly used term for manufacturing costs is product costs, which also refer to the costs of manufacturing a product. As you can see, by collecting cost data and calculating it accurately, businesses can optimize cost management and set the right price for their products to gain a competitive advantage.

More Resources

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Pricing services feels like a high-stakes gamble for every business owner. Learn about some easy-to-apply ways for monthly expense tracking, with methods.

Conclusion- Fixed Costs of Manufacturing

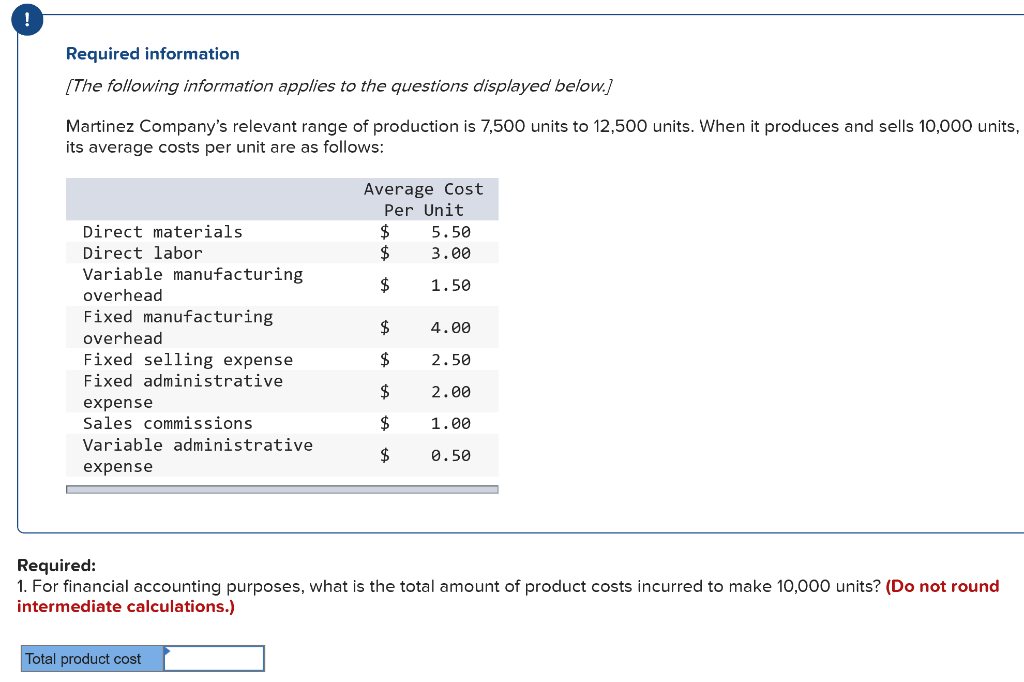

Fixed costs are expenses that remain the same no matter how much a company produces, such as rent, property tax, insurance, and depreciation. Variable costs are any expenses that change based on how much a company produces and sells, such as labor, utility expenses, commissions, and raw materials. Managers (and investors as well) should understand the inventory increase effects caused by manufacturing more units than are sold during the year. In the image below, note that the company’s variable manufacturing costs are $410 per unit, and its fixed manufacturing costs are $350 per unit. Mastering the art of calculating and managing total manufacturing costs is indispensable for any business aiming for sustainable growth and profitability. However, businesses must pay for the depreciation of their machinery, which is accounted for in their fixed overhead costs.

Direct materials constitute the raw materials and components used directly in product manufacturing. For example, wood, nails, and glue would be considered direct materials fixed manufacturing costs in producing wooden furniture. In cost accounting, the manufacturing process refers to the operations and activities that convert raw materials into finished goods.

If the company does not produce any mugs for the month, it still needs to pay $10,000 to rent the machine. One important point to note about variable costs is that they differ between industries, so it’s not at all useful to compare the variable costs of a car manufacturer and an appliance manufacturer. It’s entirely possible that the higher production level was justified — to have more units on hand for sales growth next year. Lean manufacturing principles aim to eliminate waste, optimize processes, and improve efficiency, thereby reducing overall manufacturing costs and enhancing competitiveness. Direct labor refers to employees directly involved in production tasks, while indirect labor includes employees who support production indirectly, such as supervisors and maintenance personnel.

Production costs are all the expenses related to a manufacturer conducting its business. Manufacturing costs, as we’ve already discussed, are the expenses that are needed to produce the product. This will be the cost of rent on the factory, heating, phone and other utilities, the salary of managers, packing and shipping clerks, administrative staff and so forth.