Large institutions, with their extensive networks and cutting-edge research, may have detected a pattern in the bankl Nifty well ahead of the rest. This is also the point at which you place your buy order, which will be fulfilled after the market corrects to close the gap. The stop loss must be set at the closing candle’s low. The price is expected to climb, in contrast to the ‘sell trade’ component of this approach, allowing you to get in on the action before it happens and perhaps benefit.

Yes, losses can be minimised by buying calls or puts for May expiry on Bank Nifty. Then the maximum loss will be limited to the premium paid to the seller for the call or put option. For instance, the most active call option was priced around Rs 151 at Friday closing. Although there is a lot of research and theory on how to pay bank nifty, these ideas and strategies are a good place to start if you’re new to trading.

How to trade in banknifty in Upstox?

The Bank Nifty Index can be referred for multiple purposes. For instance, benchmarking of fund portfolios, introduction of new ETFs, index funds and other structured products. By Malvika Gurung Investing.com — The domestic market made a higher opening on Wednesday following positive Asian cues as China’s manufacturing activity expanded at the fastest rate in over… It may remain weak if the index closes below the 3,500 level.

Equity benchmarks concluded an eventful week on a subdued note amid elevated volatility. Broader market relatively underperformed the benchmark as Nifty Midcap and Small cap indices lost ~2% each. Sectorally, pharma, FMCG remained in limelight while IT, metal, realty relatively underperformed. By Malvika Gurung Investing.com — Indian equity benchmark indices ended lower for the second consecutive session on Friday and extended the weekly losses to the third straight week, as… When the market opens with a gap up, this bank nifty option trading technique is ideal. When you see the market starting with a gap up, you wait for a candle to fill the gap and then place a buy order at that point.

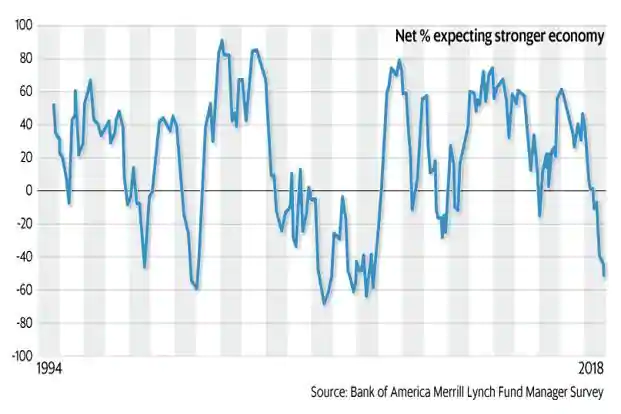

World Bank warns of ‘lost decade’ in global growth without bold policy shifts

The above chart will also change with the changes in the spot price of the BNK index. Bigger companies, such as HDFC bank, have a higher weightage, whereas smaller companies like PNB have a lower weightage. Not a single bank stock has a weight of more than 30% in the index, whereas the weight of the top three stocks together comprises 62% of the overall index. Our brokerage plans are amongst the lowest in the industry.

By Malvika Gurung Investing,com — Indian equity benchmark indices snapped a 2-day winning streak and ended lower on Thursday, with banking stocks largely exerting pressure on the domestic… In this context, it is worth mentioning that there are broad indices as well as sectoral indices. This bank nifty option technique is only applicable to intraday trading.

The Bank Nifty Chart can be used to understand the price movement and any changes in trends in the Bank Nifty Index. The data is available for multiple time frame such as daily, weekly, monthly, 3-months, etc. The weekly and monthly Bank Nifty charts are most commonly used to take entry decisions or profit booking. The Bollinger band indicates that the index has closed on the edge of the lower band, which hints at further weakness. The RSI settled below the 45-mark, which signifies a lack of strength.

It consists of 12 banking sector stocks which are highly liquid and largely capitalized. In the world of trading, lot size refers to the number of stocks that you can purchase in a single transaction. By Malvika Gurung Investing.com — The domestic market indices ended with a negative note on Thursday amid weak global cues as investors’ sentiment was dampened on fears of central banks…

Nifty का Full Form “National Stock Exchange Fifty” यह Nifty का full Form है, National Stock Exchange Fifty को हम निफ्टी कहते है . Pick up of required documents related to the account opening procedure is subject to availability of our representatives, given at any particular time and location. Dear Investor if you wish to revoke your un-executed eDis mandate, please mail us with ISIN and quantity on dp@indiratrade.com by today EOD.”

In terms of sector representation, the Nifty consists of stocks from key sectors of the Indian economy. The Nifty 50 was launched on April 1 in the year 1996, and is one of the many stock indices of NSE. It can be traded and invested in by investors as well as market intermediaries. Other popular indices include Bank Nifty, Nifty IT just to name a few. Do note that Nifty index variants include NIFTY50 USD, NIFTY 50 Total Returns Index and NIFTY50 Dividend Points Index. The trailing returns as compared to Nifty 500 then bank nifty has not given the good returns as banking sector in last 2-3 years has not done well.

The chart clearly indicates that the return on the investment is very good in long term. This is all from our side regarding How to trade in bank nifty? Although, if you have any doubts about nifty option tips, you can just comment below. Bank Nifty has a number of advantages and disadvantages.

A simple tool that gives you an idea of the corpus you can accumulate with a regular monthly investment from your income. The expiry date of all the derivatives is the last Thursday of every month, but if the last Thursday is a holiday, then the working day before last Thursday will be considered as the expiry day. The Bank Nifty future is based on volatility and open interest . If you are bullish on BNK, then you can buy its future, whereas if you are bearish, then you can short sell it. There are mainly two reasons for including only 12 stocks in the index.

- Setting your goals and putting a halt to your losses is an important part of this strategy.

- However, we also have to keep a track if the upside move is losing steam by using any momentum indicators likeRSI, ROCor any that suits your trading style.

- However, it is because of this unpredictability that this script is exceedingly risky.

- Only intraday trading is covered by this bank nifty option method.

- The movement of Bank Nifty Index can be analyzed from two parameters – fundamental and technical.

- Elements of Stock Market Investing Basics course of Stock Market by Mr Parimal Ade.

Information available on this website is solely for educational purpose only. The advice, suggestion and guidance provided through the blogs are based on the research and personal views of the experts. Please do your own research before making your investment decision. The lot size refers to the number of future and option contracts clubbed together for trading. By Malvika Gurung Investing.com — Leading Indian stock indices made a strong opening on Friday, following a risk rally in the overnight Wall Street session as banking heavyweights like JP…

Open Demat Account &

Stocks in the Dow Jones Industrial Average and S&P 500 each climbed 0.8% in early Monday trading, whilst Nasdaq-traded First Citizens BancShares rose 40% in premarket trading. However, the risks of a recession persist due to the high interest rates squeezing lenders. The managing director of the International Monetary Fund, Kristalina what is bank nifty in share market Georgieva, said that financial stability risks are rising as interest rates increase to combat inflation. You cannot directly invest in the Nifty 50 index; instead, you can buy nifty 50 shares that comprise of all the 50 companies on the Index. You must buy the shares in the same proportion or invest in index funds and ETFs.

Pay 20% upfront margin of the transaction value to trade in cash market segment. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Promoters held 75 per cent stake in the company as of December 2022, while FIIs owned 0 per cent, DIIs 0 per cent. Our weekly finance newsletter with insights you can use. The corporate office location is at Dalal Street, Mumbai.

This index is one of the indexes where there is a high amount of trading involved in the market. In this article, we will be discussing in detail regarding the Nifty Bank Index, its methodology, constituents, and finally its performance as we move forward. A Fundamental based, diversified small & midcap portfolio for very high risk takers. A lot of derivative contracts standardize the contracts and help the trader know exactly the exact number of contracts being bought in a trade. The lot size is comprised of 25 contracts, which are grouped together.

Why are only 12 bank stocks included in the index?

It was founded in 1992 while trading on Nifty was initiated in 1994. As such, there is no significant difference between Sensex and Nifty. Option chain can be used by traders to examine action in deep OTM calls and puts. A quick spike in deep OTM calls and puts is usually indicative of a breakout in that direction. For instance, if the candle is 50 units long, your target should be 100. This Bank nifty option strategy has a few crucial features.

The maximum weightage of a single stock does not exceed 34% and the cumulative weightage of the top three stocks does not cross 63% in the Bank Nifty weightage. By Malvika Gurung Investing.com — An intense sell-off was witnessed across Dalal Street on Friday after the Indian benchmark indices opened sharply lower in early trade, following negative… By Malvika Gurung Investing.com — The domestic market indices ended with gains on Friday, while closing the volatile week with sharp cuts driven by the brewing banking crisis in the US. By Malvika Gurung Investing.com — Leading Indian stock indices ended higher on Tuesday, erasing the previous session’s losses amid positive cues from global markets following easing… For the latest stock performance, the Nifty index reconstitution happens every six months.

The next step is to decide when you want to start your approach. The significance of Bank Nifty is that it provides investors with a benchmark for the Indian banking sector’s market performance. The bank nifty option chain is useful, or we can say very popular, among all the F & O traders. On one hand, Bank Nifty is particularly appealing to traders aiming for a rapid profit because to its high volatility, as price spikes are more likely with this script.

National Stock Exchange एक Stock Exchange है और Fifty का मतलब 50 यानी पचास है. इसको हम कुछ इस तरह कह सकते है National stock Exchange के 50 shares. The Regulatory Sandbox was established in 2020 by the Reserve Bank of India to foster responsible innovation in financial services, promote efficiency and bring benefits to end users.

Bank Nifty Kya Hai

TradeSmart is equipped to offer one of the best intraday exposures. Hence, you need not worry about financing your big investment plans. Good customer care, fast fund transfer, NEST – all time good trading software but in-house software SPIN is need to improve a lot. There process to reset password is lightning fast too which helps not losing too much trading time. An option chain lists all the option strike prices along with the premium for a specific maturity period. You can check the Bank Nifty Option chain along with the Bank Nifty spot prices on the TradeSmart portal.

According to analysis and trend analyses, the price is anticipated to fall from here. As a result, the sell order protects you against the price drop. The top stocks of the index include HDFC Bank Ltd. 31.61%, ICICI Bank Ltd. 18.20%, Axis Bank Ltd. 13.02%, Kotak Mahindra Bank Ltd. 12.74% and State Bank of India 10.92%.